Reliable, AI Powered Fintech

Speed, time to market, 100% compliant, and self editable on an intelligent Fintech platform is more flexible, cost efficient, and less risk

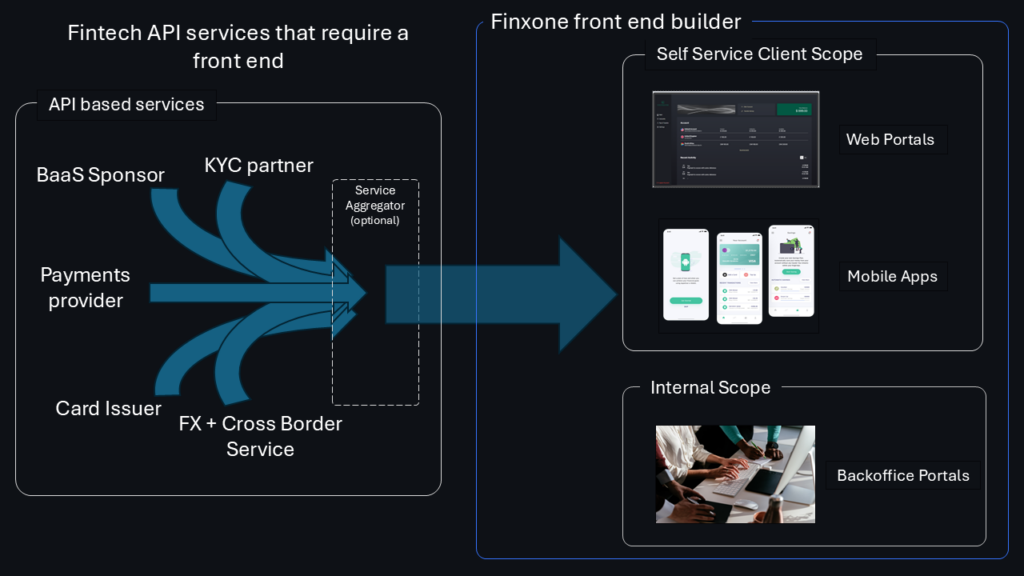

Your platform as a service. In one place, with the Finxone front end platform, integrated to Railsr’s world class APIs, fully compliant to FCA, Railsr, and scheme and association rules.

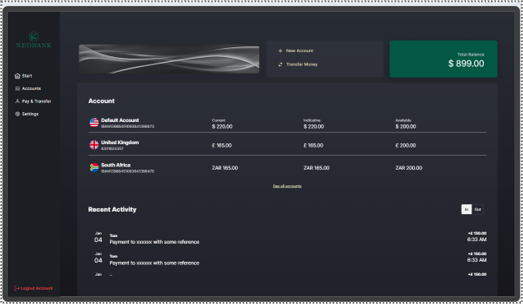

Your Finxone frontend powered by Railsr automates deployments to Android, IOS, and Web portals and can let you customise every screen and every flow to your exact requirements.

Unlike other front-end as a service providers, you can bring your own code, change workflows, add new features, and we allow you to build your powerful differentiators and combine them with our own platform capabilities, all backed by the world class payments, and value added infrastructure on Railsr.

Finxone is tightly integrated with the Railsr API suite so that you can use them as an easy to use, configurable set of graphical widgets and workflows. These are the API functionalities that are ready to be activated.

Our team will build your compliant flows with onboarding, main screens, payments, cards, and any other project areas in scope.

You can edit and evolve your design in real time with us.

30 days and you are ready to show the world.

Speed, time to market, 100% compliant, and self editable on an intelligent Fintech platform is more flexible, cost efficient, and less risk

With Finxone, you get more than just an app—you gain a comprehensive environment that includes essential services such as user account management, secure databases, customizable preferences, and notification systems. Finxone also integrates seamlessly with additional service providers and value-added services (VAS) like pre-payment AML checks, overseas VAT reclamation on transactions, and cashback and loyalty programs. This integrated approach ensures that your application is not only functional but enriched with features that enhance user experience and streamline operations.

Once your sandbox application is live and running you can apply to our service providers and partners for permission to go live on their products and services.

*note building an MVP does not guarantee acceptance by any licensed provider.

Choose which of the Core Fintech services you require for your application. Is your application based around an accounts programme or a card programme? do you need business or retail accounts? If you would like to offer a Business account application you will need to build it on top of either a retail account or Card programme. For Cad programmes Finxone will include the in app card requirements for both physical and digital cards. If you require cards to be integrated to Google and Apple Pay Digital wallets, please speak to our sales team.

A Railsr Focussed Deployment is one which backs onto the Core Railsr services and does not require more complex integrations or developments.

Finxone has developed a unique app design and deployment platform that serves as the foundation for all our applications. This innovative platform enables unparalleled flexibility and rapid “speed to live” for your fintech solutions. Whether you’re building a Proof of Concept (POC) or going straight to a Minimum Viable Product (MVP) for live testing on fintech rails, Finxone’s App Builder is designed to get you there faster and with reduced risk.

All applications built on our platform are subject to an annual licensing fee.

**For Multi-Currency Cards, this module goes to £5,000 to account for the complexity in Ledger and transaction management.

**For Multi-Currency Cards, this module goes to £5,000 to account for the complexity in Ledger and transaction management.

Business accounts cater to companies, offering multi-user access, expense tracking, and tools for managing higher transaction volumes. In contrast, personal accounts are tailored for individual users, focusing on everyday banking needs like deposits, bill payments, and card transactions. Business accounts provide advanced features to handle the complexity of professional financial operations.

**For Multi-Currency Cards, this module goes to £90,000 to account for the complexity in Ledger and transaction management.

Finxone isnt just a portal to bring to life Railsr’s API services we can also act as a service integrator and integrate, otherwise parallel services int your application. If your application is either for over 1,000 users or requires more than an integration into Railsr you will need to use this pricing model.

Finxone has developed a unique app design and deployment platform that serves as the foundation for all our applications. This innovative platform enables unparalleled flexibility and rapid “speed to live” for your fintech solutions. Whether you’re building a Proof of Concept (POC) or going straight to a Minimum Viable Product (MVP) for live testing on fintech rails, Finxone’s App Builder is designed to get you there faster and with reduced risk.

All applications built on our platform are subject to an annual licensing fee.

**For Multi-Currency Cards, this module goes to £5,000 to account for the complexity in Ledger and transaction management.

**For Multi-Currency Cards, this module goes to £90,000 to account for the complexity in Ledger and transaction management.

Business accounts cater to companies, offering multi-user access, expense tracking, and tools for managing higher transaction volumes. In contrast, personal accounts are tailored for individual users, focusing on everyday banking needs like deposits, bill payments, and card transactions. Business accounts provide advanced features to handle the complexity of professional financial operations.

**For Multi-Currency Cards, this module goes to £90,000 to account for the complexity in Ledger and transaction management.

Depending on your chosen support level, you’ll benefit from regular compliance and security updates, including platform, iOS, and Android updates, as well as access to widget and workflow upgrades. Additional options include Google Analytics support, Apple Pay and Google Pay functionality, and tools like Hotjar and Sentry to monitor and optimize your user experience. For businesses with more complex requirements, we offer features like self-hosted authentication services, A/B testing, and production backups. Our support packages ensure that your Finxone solution remains cutting-edge, secure, and tailored to your evolving needs.

With Finxone’s integration to Railsr’s end-user API, setting up a user management system becomes seamless. Finxone provides easily reusable widgets and workflows for essential end-user operations, including managing user profiles, handling KYC (Know Your Customer) processes, and associating multiple account persons—all through pre-built, compliant modules. This interface empowers our app builders to efficiently create workflows for the creation, updating, and retrieval of user data, while KYC verification is streamlined with pre-integrated access to endpoints for submitting, retrieving, and managing KYC results and documentation.

By leveraging Finxone’s stylable UI/UX components, businesses can quickly build branded applications for mobile and desktop, significantly reducing the time, cost, and complexity of implementing end-user functionalities. This pre-integration ensures a compliant, secure, and scalable solution for managing customer onboarding and verification, making Finxone a compelling choice for any Railsr-based application.

Finxone’s integration also ensures that all API responses, not just successful ones, are managed effectively. Beyond handling standard 200 success responses, Finxone’s workflows and widgets are designed to automatically account for potential 40x responses, including user errors, authentication issues, and data validation failures. This built-in resilience means that applications built with Finxone can manage edge cases smoothly, providing users with clear, actionable feedback rather than unexpected failures. By addressing these response scenarios proactively, Finxone allows businesses to launch robust applications that maintain reliability and user trust, minimizing the need for additional custom error-handling logic from in-house teams.

With Finxone’s pre-integration to Railsr’s Transactions API, building and launching a financial application with robust transaction capabilities is faster and easier than ever—no developers required. Finxone provides a suite of pre-configured screens and workflows that handle all key transaction functions, including creating money transfers, interledger transactions, and virtual ledger credits and debits. These workflows are designed to work seamlessly, so all you need to do is style them to match your brand.

Additionally, Finxone includes ready-made options for transaction history and details, enabling you to implement a comprehensive payments history or transaction management feature in minutes. With built-in capabilities for viewing transaction details, updating metadata, and rerunning transactions, Finxone allows you to deliver a fully functional transaction experience without the need for complex development.

By leveraging Finxone’s pre-integrated, customizable components, you can rapidly deploy a Railsr-based application that meets compliance requirements and provides a smooth, user-friendly experience across mobile and desktop—bringing your product to market faster and at a lower cost.

Finxone’s integration also ensures that all API responses, not just successful ones, are managed effectively. Beyond handling standard 200 success responses, Finxone’s workflows and widgets are designed to automatically account for potential 40x responses, including user errors, authentication issues, and data validation failures. This built-in resilience means that applications built with Finxone can manage edge cases smoothly, providing users with clear, actionable feedback rather than unexpected failures. By addressing these response scenarios proactively, Finxone allows businesses to launch robust applications that maintain reliability and user trust, minimizing the need for additional custom error-handling logic from in-house teams.

Finxone simplifies managing beneficiaries in your application by providing a ready-to-use interface for Railsr’s beneficiaries API. Instead of developing complex workflows to create, update, and verify beneficiaries, Finxone offers pre-built screens and workflows that handle everything from adding new beneficiaries to managing their accounts and verifying them for specific payment types. With endpoints for creating beneficiaries, updating details, verifying new beneficiaries, and managing multiple beneficiary accounts, Finxone’s interface allows app builders to easily implement comprehensive beneficiary management without diving into API documentation.

Additionally, Finxone enables app builders to customize the UI/UX to align with their brand, ensuring a seamless user experience across both mobile and desktop formats. The pre-integrated workflows handle not only the basic beneficiary functions but also advanced options like setting a default account, calculating beneficiary details, and verifying eligibility for different payment types. This approach helps developers deliver a compliant, user-friendly solution, drastically reducing development time and effort for applications built on the Railsr platform.

Finxone’s integration also ensures that all API responses, not just successful ones, are managed effectively. Beyond handling standard 200 success responses, Finxone’s workflows and widgets are designed to automatically account for potential 40x responses, including user errors, authentication issues, and data validation failures. This built-in resilience means that applications built with Finxone can manage edge cases smoothly, providing users with clear, actionable feedback rather than unexpected failures. By addressing these response scenarios proactively, Finxone allows businesses to launch robust applications that maintain reliability and user trust, minimizing the need for additional custom error-handling logic from in-house teams.

Finxone simplifies the activation of financial ledgers within Railsr applications, enabling businesses to efficiently handle single-user and omnibus (multi-asset) ledgers. Through Finxone’s pre-built screens and workflows, app builders can easily set up and manage ledgers for different asset types—including GBP, EUR, USD—whether they’re assigned to individual end-users or to a central omnibus ledger for a customer.

Finxone provides out-of-the-box functionality for creating and updating ledgers, viewing ledger history, and managing virtual ledgers, eliminating the need to manually implement each of these API endpoints. With customizable UI/UX components, businesses can ensure that the ledger management experience aligns with their brand and user expectations, delivering a seamless experience across mobile and desktop platforms.

By leveraging Finxone’s integrated approach, application builders save time and reduce complexity while ensuring that their applications are robust and compliant.

Finxone’s integration also ensures that all API responses, not just successful ones, are managed effectively. Beyond handling standard 200 success responses, Finxone’s workflows and widgets are designed to automatically account for potential 40x responses, including user errors, authentication issues, and data validation failures. This built-in resilience means that applications built with Finxone can manage edge cases smoothly, providing users with clear, actionable feedback rather than unexpected failures. By addressing these response scenarios proactively, Finxone allows businesses to launch robust applications that maintain reliability and user trust, minimizing the need for additional custom error-handling logic from in-house teams.

Finxone makes it easy to implement real-time notifications for Railsr applications, allowing users to stay informed about critical account activities, such as pending transactions, card activations, or transaction declines. By leveraging Finxone’s pre-built screens and workflows, application builders can quickly set up notification subscriptions without having to manually integrate each endpoint. With endpoints for creating, retrieving, updating, and removing notification subscriptions, as well as testing and configuring retry policies, Finxone enables comprehensive management of user notifications.

The interface provided by Finxone is fully customizable, allowing businesses to align notifications with their brand while maintaining compliance and reliability. With robust error-handling capabilities, Finxone ensures that notification delivery remains consistent even during edge cases. By handling the backend complexities, Finxone allows app builders to focus on crafting a seamless user experience, helping applications remain responsive and proactive in keeping users informed about their account activity on the Railsr platform.

Finxone’s integration also ensures that all API responses, not just successful ones, are managed effectively. Beyond handling standard 200 success responses, Finxone’s workflows and widgets are designed to automatically account for potential 40x responses, including user errors, authentication issues, and data validation failures. This built-in resilience means that applications built with Finxone can manage edge cases smoothly, providing users with clear, actionable feedback rather than unexpected failures. By addressing these response scenarios proactively, Finxone allows businesses to launch robust applications that maintain reliability and user trust, minimizing the need for additional custom error-handling logic from in-house teams.

Finxone streamlines the process of building a front end for Railsr’s FX inter-ledger API, making it easier to manage foreign exchange transfers across GBP, EUR, and USD directly within your application. With Finxone, you don’t need to develop custom screens or workflows to use endpoints like FX quote retrieval and FX transfer execution; these functionalities are available as pre-built, compliant screens and workflows, ready to deploy across mobile and desktop.

Using Finxone’s customizable UI/UX components, developers can easily tailor the appearance of these FX tools to match their brand, ensuring a cohesive user experience without the complexity of manual integration. By handling FX quotes, transfers, and real-time currency exchange processes, Finxone reduces development time, ensures regulatory compliance, and provides a seamless, reliable user interface for foreign exchange operations—all while avoiding the need to navigate API documentation or handle backend complexities. This makes Finxone a robust solution for any Railsr-based application involving multi-currency transfers.

Finxone’s integration also ensures that all API responses, not just successful ones, are managed effectively. Beyond handling standard 200 success responses, Finxone’s workflows and widgets are designed to automatically account for potential 40x responses, including user errors, authentication issues, and data validation failures. This built-in resilience means that applications built with Finxone can manage edge cases smoothly, providing users with clear, actionable feedback rather than unexpected failures. By addressing these response scenarios proactively, Finxone allows businesses to launch robust applications that maintain reliability and user trust, minimizing the need for additional custom error-handling logic from in-house teams.