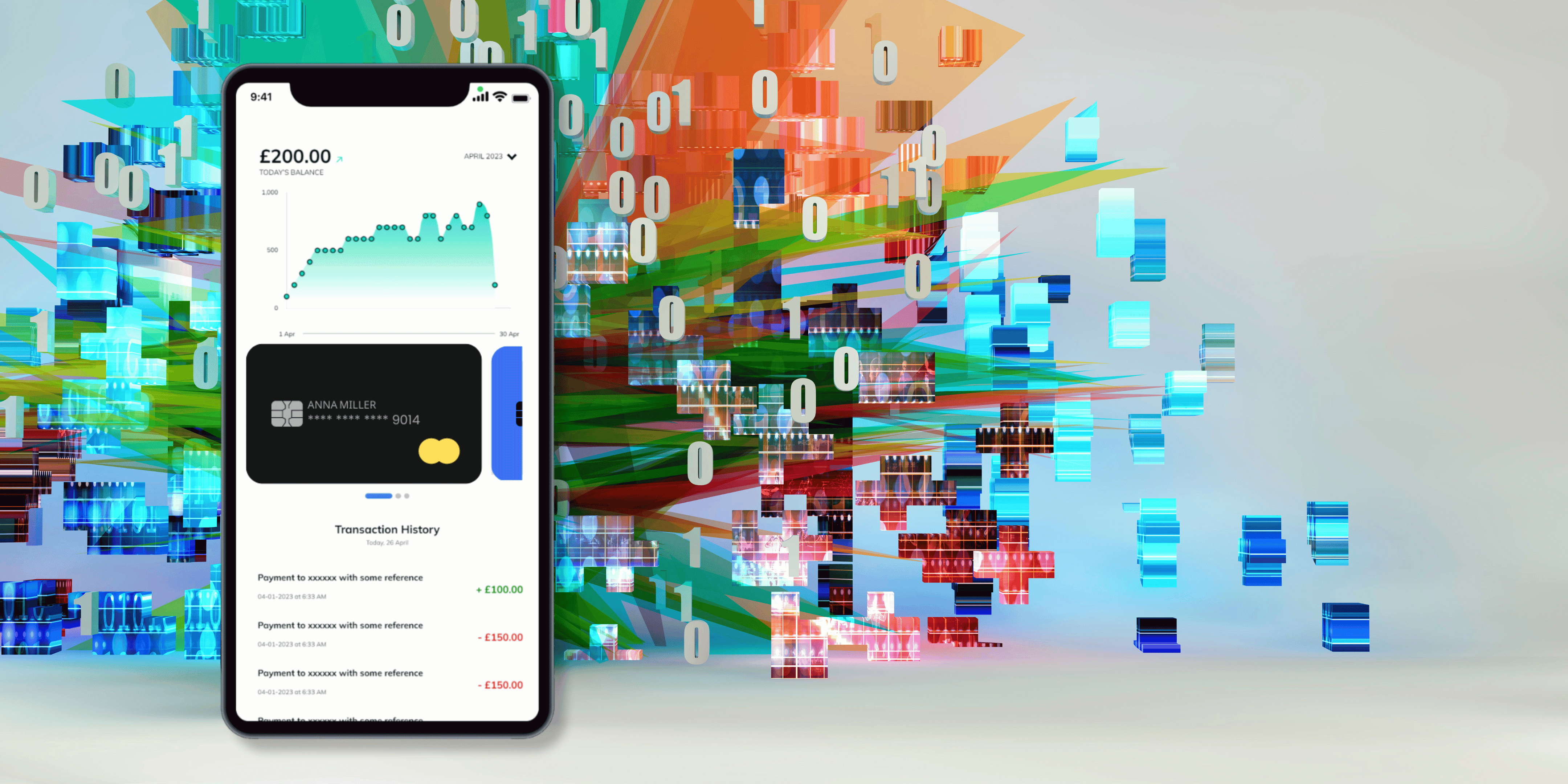

Finxone’s integration with BaaS (Banking as a Service) providers enables the issuance of virtual cards, offering several benefits to businesses and users alike. Virtual cards are digital representations of payment cards that can be used for online transactions, in-app purchases, or contactless payments.

Benefits of Using Virtual Cards with Finxone

Enhanced Security

Virtual cards provide an added layer of security compared to physical cards. They are not susceptible to loss, theft, or unauthorised use, reducing the risk of fraudulent activities. Each virtual card is typically associated with unique card details, making it more secure for online transactions.

Convenient and Instant Issuance

With Finxone’s integration, virtual cards can be issued quickly and conveniently. There’s no need to wait for physical card delivery or visit a bank branch. Users can generate virtual cards instantly through the Finxone platform, making them ideal for immediate use in various digital payment scenarios.

Flexibility and Customisation

Virtual cards offer flexibility and customisation options. Users can set spending limits, define expiration dates, or restrict usage to specific merchants or transaction types. Businesses can tailor virtual card features to match their specific requirements, allowing for better control over expenses and enhanced budget management.

Seamless Integration and Management

Finxone simplifies the integration and management of virtual cards. The platform seamlessly integrates with BaaS providers, streamlining the process of card issuance, activation, and usage. Businesses can manage virtual cards centrally through the Finxone interface, making it easy to monitor transactions, track expenses, and analyse spending patterns.

Cost Savings and Efficiency

Virtual cards can contribute to cost savings and operational efficiency. Businesses can eliminate the costs associated with physical card production, distribution, and maintenance. Virtual cards also reduce the administrative burden of reconciling paper receipts, as transaction details are readily available within the Finxone platform.

Improved User Experience

Virtual cards offer a modern and user-friendly payment experience. They align with the growing trend of digital payments and cater to the preferences of tech-savvy users who prefer convenience, speed, and security in their financial transactions. By leveraging Finxone’s virtual card capabilities, businesses can enhance their customer experience and drive user satisfaction.