Finxone Pre-Integrated to Integrated Finance

Imagine a scenario where building a fintech application involves simply dragging and dropping pre-designed widgets that are directly linked to Integrated Finance’s APIs.

Imagine a scenario where building a fintech application involves simply dragging and dropping pre-designed widgets that are directly linked to Integrated Finance’s APIs.

Where Creativity Meets Efficiency

Finxone’s Global Styling feature emerges as a beacon of hope for fintech application designers seeking a harmonious design experience.

By leveraging the capabilities of Finxone, businesses can effectively address potential risks and focus on delivering innovative fintech solutions while minimising potential pitfalls and challenges along the way.

From the first product design meetings, the Finxone platform has been built with compliance in mind.

According to Gartner, it is projected that 75% of technology solutions will be built with no code by 2028, highlighting the growing importance of nocode development in the fintech industry.

Gone are the days of high costs, complexity, and regulatory hurdles, as Finxone simplifies the process, allowing organisations of all sizes to create branded programs tailored to their specific needs.

Finxone’s backoffice functionality provides a comprehensive and user-friendly tool for managing customers, configuring specialised zones, and customising various aspects of your application, empowering you to efficiently oversee your business operations and deliver an exceptional user experience.

Due to the integration of KYB capabilities into the Finxone platform, the KYB process is streamlined by providing comprehensive databases, automating data collection and verification, and leveraging advanced technologies, enhancing the accuracy, efficiency, and compliance of businesses’ KYB checks.

With Finxone’s integrated KYC solution, the process of verifying and authenticating customer identities becomes significantly easier and more efficient.

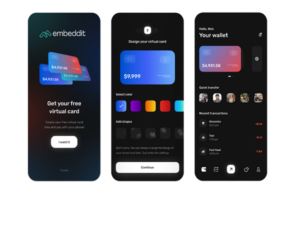

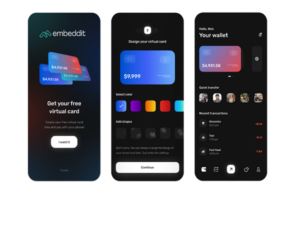

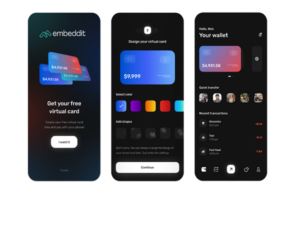

Virtual cards offer a modern and user-friendly payment experience, enhanced security and enhanced flexibility and customisation options.

(+44) 203 574 9360

info@finxone.dev

41 Luke Street, Shoreditch, London, EC2A 4DP

Connect to us to get the best of Finxone news, updates, and new features. No spam, no marketing

© 2025 Finxone Ltd. Registered in England & Wales 14307761